BY: Ann Vandersteel, Co-Founder American Made Foundation *& American Made Action

Sponsored by: American Made Foundation

Please consider donating to the efforts of education so that We the People can re-learn how to govern ourselves as a constitutional republic, for which we were founded!Questions to ponder:

Intro:

For most Americans, the 14th Amendment represents equal protection, civil rights, and a key legal foundation of modern America. But what if everything you thought you knew about it… was a lie?

The Truth Congress Buried in 1868

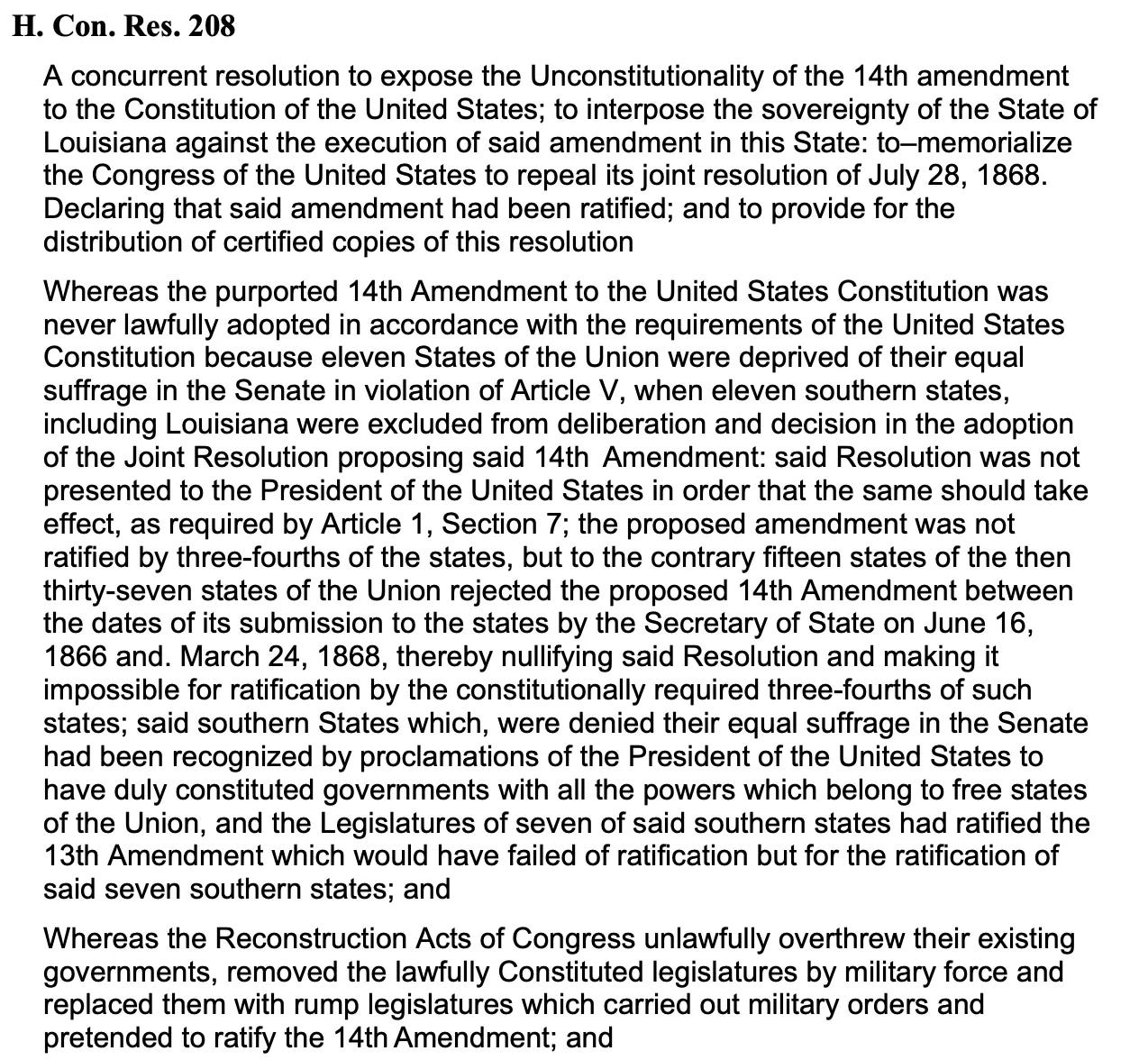

According to H. Con. Res. 208, introduced to expose the fraud, the 14th Amendment was never lawfully ratified. It was passed not by legal consensus, but by coercion, military force, and legislative fraud.

Between June 1866 and March 1868, fifteen states rejected the amendment—more than enough to defeat it. The U.S. Constitution requires approval by three-fourths of the states. That never happened.

Instead, Congress declared southern states “in rebellion,” removed their duly-elected legislatures, and installed federal-controlled puppet governments. These “rump” legislatures rubber-stamped the amendment under military pressure.

From Sovereigns to Subjects

Before 1868, Americans were citizens of their states, electing representatives in a decentralized, constitutional republic. After the 14th Amendment? We became U.S. citizens—subjects of a federal corporation operating from Washington, D.C.

This legal shift opened the door to federal taxation, central banking, mass surveillance, and the erosion of state sovereignty.

The Insurrection Clause: A Modern Weapon

Now, Section Three of the 14th Amendment—the Insurrection Clause—is being weaponized to block Donald Trump from office. Yet, he hasn’t been charged, tried, or convicted of insurrection. This clause was never intended to be used without due process—but here we are.

If the foundation of the 14th is rotten, how can its clauses be legally applied?

The Real Question: Who Do We Belong To?

Are we state nationals, under the Constitution our founders fought for?

Or are we federal property, managed under emergency powers, digital IDs, and never-ending debt?

Conclusion: The Reckoning Has Begun

The truth has surfaced. The theft is exposed. It’s time to reclaim our sovereignty, restore our republic, and remind the federal government: We are not your property. We are the People.

Join the conversation. Share this. Wake the nation.

#14thAmendment #Trump2024 #WeAreNotSubjects

Bonus Content

Here's a comparison of this charge against him and the jurisdictional discussion of American Nationals and taxation:

1. The Scope of Legal Jurisdiction

Jurisdictional Argument on Taxation:

The idea behind the taxation discussion is that the 50 states operate under a separate legal jurisdiction from Washington, D.C., specifically regarding who qualifies as a "taxpayer" under federal tax law. Under this perspective, not everyone is legally subject to the federal revenue laws imposed within the District of Columbia.Implication: The legal difference between being a statutory taxpayer and an American National is rooted in whether federal jurisdiction is properly applied.

Application of Jurisdiction in Section Three:

Section Three addresses the jurisdiction of federal authority over individuals who swore an oath to uphold the Constitution but are accused of rebellion or insurrection. The legal threshold for insurrection depends on whether the actions in question legally fall within the definition of a rebellion against the U.S. government.

2. The Meaning of “Insurrection” and Its Threshold

Tax Argument:

The argument around taxation hinges on whether Americans are correctly categorized under jurisdiction. Much like determining if a person is a “taxpayer,” insurrection under Section Three isn’t automatically applied. It requires proof that the person actively rebelled against the government—a term with a strict legal interpretation.For Trump:

Section Three’s application depends on whether Trump’s involvement in the events of January 6 meets the legal threshold of “engaging in insurrection or rebellion”. Critics argue his rhetoric incited violence, while Trump’s defense maintains that his actions do not meet the legal definition of insurrection, citing freedom of speech and lack of direct involvement in violent acts.

3. Burden of Proof and Legal Proceedings

In Tax Cases:

Determining whether someone is subject to federal tax laws often requires a court ruling to clarify their jurisdictional status (resident or non-resident taxpayer). Similarly, determining whether someone is an insurrectionist under Section Three requires a formal adjudication.For Trump:

No formal criminal conviction for insurrection exists. While some members of Congress argue that Section Three applies, legal scholars contend that without a court ruling or due process, barring Trump from office based on insurrection could violate his constitutional rights.

4. Role of Congress vs. Courts

In Tax Jurisdiction:

Federal courts often have the final say in determining who is subject to federal taxes, with Congress establishing general guidelines. However, in jurisdictional disputes, specific evidence must be presented before a person can be classified as a taxpayer.Section Three’s Application:

Congress plays a direct role in removing the disability imposed by Section Three. By a two-thirds vote, it can allow individuals accused of insurrection to hold office. However, the initial determination of insurrection typically involves legal proceedings, not just political accusations.

5. Broader Constitutional Implications

Taxation Debate:

The taxation debate questions whether Americans understand the full scope of jurisdictional limits on federal laws and whether they are being misclassified as federal “taxpayers.”Section Three and Trump:

The insurrection debate similarly involves questions about constitutional limits on who has jurisdiction to label someone as an insurrectionist. Should such accusations be resolved in courts or left to political bodies like Congress?

Summary:

Just as the taxation debate questions who is legally within the scope of federal revenue laws, the Section Three argument about Trump highlights the need for clarity on legal definitions. Both discussions underscore how jurisdiction and due process are critical in ensuring that constitutional provisions are properly applied.

For Taxpayers: Misclassifying someone as a statutory taxpayer could result in unconstitutional taxation.

For Trump: Misapplying Section Three without proper legal adjudication risks violating his constitutional right to due process and political participation.

For your review:

14th Amendment 39th Congress [Final Amendment]

Section One

All persons born or naturalized in the United States, and subject to the jurisdiction thereof, are citizens of the United States and of the State wherein they reside. No State shall make or enforce any law which shall abridge the privileges or immunities of citizens of the United States; nor shall any State deprive any person of life, liberty, or property, without due process of law; nor deny to any person within its jurisdiction the equal protection of the laws.

Section Two

Representatives shall be apportioned among the several States according to their respective numbers, counting the whole number of persons in each State, excluding Indians not taxed. But when the right to vote at any election for the choice of electors for President and Vice-President of the United States, Representatives in Congress, the Executive and Judicial officers of a State, or the members of the Legislature thereof, is denied to any of the male inhabitants of such State, being twenty-one years of age, and citizens of the United States, or in any way abridged, except for participation in rebellion, or other crime, the basis of representation therein shall be reduced in the proportion which the number of such male citizens shall bear to the whole number of male citizens twenty-one years of age in such State.

Section Three

No person shall be a Senator or Representative in Congress, or elector of President and Vice-President, or hold any office, civil or military, under the United States, or under any State, who, having previously taken an oath, as a member of Congress, or as an officer of the United States, or as a member of any State legislature, or as an executive or judicial officer of any State, to support the Constitution of the United States, shall have engaged in insurrection or rebellion against the same, or given aid or comfort to the enemies thereof. But Congress may by a vote of two-thirds of each House, remove such disability.

Section Four

The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned. But neither the United States nor any State shall assume or pay any debt or obligation incurred in aid of insurrection or rebellion against the United States, or any claim for the loss or emancipation of any slave; but all such debts, obligations and claims shall be held illegal and void.

Section Five

The Congress shall have power to enforce, by appropriate legislation, the provisions of this article.

Share this post